Rule of 72 by kent answer key – Welcome to the fascinating world of the Rule of 72 by Kent, a simple yet powerful tool that unlocks the secrets of financial planning. This rule provides a quick and easy way to estimate the doubling time for investments, empowering you to make informed decisions about your financial future.

The Rule of 72 is a mathematical formula that harnesses the power of compound interest to reveal how long it takes for an investment to double in value. Its simplicity and versatility make it an indispensable tool for both novice and seasoned investors alike.

Introduction: Rule Of 72 By Kent Answer Key

The Rule of 72 is a simple yet powerful financial planning tool that allows you to estimate the time it takes for an investment to double in value, given a constant annual interest rate. It’s a quick and easy way to get a ballpark figure for how long it will take your money to grow exponentially.

The Rule of 72 is significant in financial planning because it helps you make informed decisions about your investments. By understanding how long it will take for your money to double, you can plan for the future and set realistic financial goals.

Formula and Application

The Rule of 72 is a simple formula that can be used to estimate the doubling time of an investment. The formula is as follows:

Doubling Time = 72 / Annual Return Rate

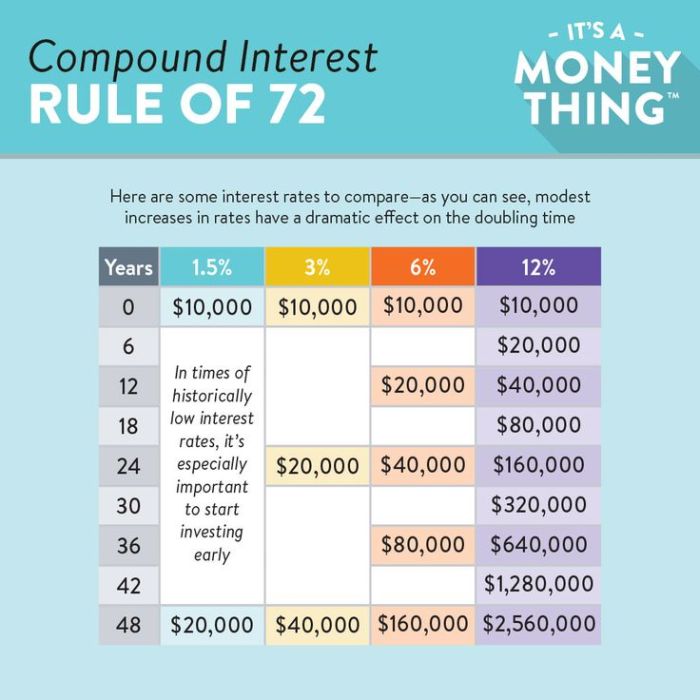

For example, if an investment has an annual return rate of 6%, then the doubling time would be 72 / 6 = 12 years.

Examples of Application

The Rule of 72 can be used to estimate the doubling time for a variety of investments, including:

- Savings accounts

- Certificates of deposit (CDs)

- Money market accounts

- Bonds

- Stocks

The Rule of 72 is a simple and easy-to-use formula that can be a helpful tool for investors.

Limitations and Assumptions

The Rule of 72 is a simple and convenient tool for estimating the time it takes for an investment to double, but it has some limitations and assumptions that users should be aware of.

One limitation of the Rule of 72 is that it assumes a constant growth rate. In reality, investment growth rates can fluctuate over time, which can make the Rule of 72 less accurate. Additionally, the Rule of 72 does not take into account the effects of inflation, which can erode the value of investments over time.

To gain a deeper understanding of financial concepts, the Rule of 72 by Kent Answer Key provides valuable insights. For a break from numerical analysis, dive into the compelling Just Mercy Chapter 14 Summary . This captivating account explores themes of justice and redemption, offering a poignant reminder of the human impact behind legal complexities.

Returning to the financial realm, the Rule of 72 by Kent Answer Key empowers individuals to make informed decisions, ensuring a sound understanding of financial principles.

Assumptions, Rule of 72 by kent answer key

The Rule of 72 makes the following assumptions:

- The growth rate is constant.

- The investment is compounded annually.

- The effects of inflation are negligible.

These assumptions can limit the accuracy of the Rule of 72, especially for long-term investments or investments with variable growth rates.

Variations and Extensions

The Rule of 72 is a versatile tool that can be adapted to various types of investments. By adjusting the number in the denominator, we can create variations of the rule for different scenarios.

One common variation is the Rule of 114, which is used to estimate the doubling time of investments with a compound annual growth rate (CAGR) of 8%. The formula for the Rule of 114 is:

Doubling Time = 114 / CAGR

For example, if an investment has a CAGR of 8%, its doubling time would be approximately 14.25 years (114 / 8).

Another variation is the Rule of 144, which is used to estimate the doubling time of investments with a CAGR of 5%. The formula for the Rule of 144 is:

Doubling Time = 144 / CAGR

For example, if an investment has a CAGR of 5%, its doubling time would be approximately 28.8 years (144 / 5).

Applications in Practice

The Rule of 72 is a valuable tool for financial planning, enabling individuals and advisors to make informed decisions about investments and financial goals. It provides a quick and easy way to estimate the doubling time of investments and plan for the future.

For investors, the Rule of 72 can help them understand the potential growth of their investments. By knowing the interest rate or expected return, they can estimate how long it will take for their money to double. This information can help them make informed decisions about asset allocation, risk tolerance, and retirement planning.

For Financial Advisors

Financial advisors also find the Rule of 72 useful in their practice. It helps them provide clients with realistic expectations about the potential growth of their investments. By using the Rule of 72, advisors can illustrate the impact of different interest rates and investment strategies on the client’s financial goals.

For example, an advisor may use the Rule of 72 to show a client that if they invest $10,000 at a 6% annual return, it will take approximately 12 years for their investment to double to $20,000. This information can help clients make informed decisions about their financial future and set realistic expectations.

Question Bank

What is the formula for the Rule of 72?

The formula for the Rule of 72 is: Doubling Time = 72 / Annual Interest Rate.

How do I use the Rule of 72 to estimate the doubling time for my investment?

To estimate the doubling time for your investment using the Rule of 72, simply divide 72 by the annual interest rate expressed as a percentage.

What are the limitations of the Rule of 72?

The Rule of 72 assumes a constant annual interest rate, which may not always be the case in real-world scenarios.